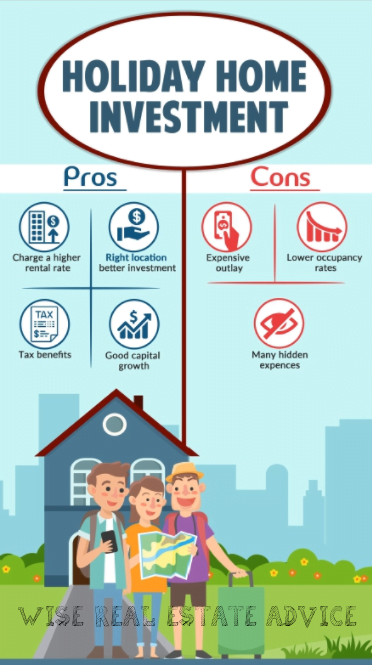

The seductive idea that’s crossed most property investor’s minds, is buying a holiday home a good investment? It makes good financial sense to have such a luxury item in their portfolio that has the ability to generate such a high rental income at well as the regular capital growth a property makes. If you’ve ever hired out a holiday house, you would know the rates are astronomical!

Although, as with any type of financial investment there are positives and negatives. To ensure you make the right decision, you need to explore these and then make a calculated decision as to whether it’s the right choice. Our buyers agents have covered over a few topics you must know about when buying a holiday home.

Holiday Home Must Have’s

1. Choosing the right property in the right location

In a property boom period all properties perform well, this includes holiday homes too! When sourcing a holiday home choose a prime location as this will be a much better financial decision. Sea views, with nearby restaurants, shops and tourist hotspots are other very important features to consider. Ensuring there is major infrastructure close to your property will mean a more consistent flow of rental income.

Australia is very well known for the most beautiful beaches in the world by Aussies and overseas visitors alike. Your holiday home will be in much higher demand if it is located near the beach. Proximity to the beach and a sea view make a big difference when it comes to success with holiday letting.

If you intend to have a more consistent rental income, that coastal location will need to be in the northern parts of Australia.

2. Choosing the right style

As it may feel tempting to purchase a cheaper, smaller property that may yield a higher rental return on purchase price you should choose a holiday home that has a large living room, separate bedrooms, a kitchen etc. as this type of property often has better capital growth and later on down the track you may wish to move in yourself.

3. Money Matters

A rental of a holiday home yields a much higher rate than that of a regular rental property in the suburbs. This is a very attractive and enticing thing when initially considering buying a holiday home.

During tax time, because the holiday home is an investment, you can claim deductions (including interest expenses)! Just be mindful that this must be proportioned according to the time it was rented out and not the time used for your own personal use. Some short stay accommodation qualifies for 4% depreciation for 25 years instead of the standard 2.5% for 40 years.

Investors, Beware Of:

1. Expensive and unstable property prices

In these recent good times of property investing many holiday homes in ideal locations are too expensive for many investors.

The other issue is that the property prices in these ideal locations are unstable. During economic hard times holiday homes are high on the list of expendable assets for investors. Yet, even in financial good times properties in these coastal areas don’t sell as quickly as properties in the capital cities.

2. Low Occupancy Rates

You will need to allow for lengthy vacancy periods and fluctuating occupancy levels throughout different times of the year.

The average period of time a holiday rental is hired out is 8 to 10 weeks per year. A return on holiday home investment can vary widely although in the bad times, holiday homes that lack that prime location may experience low occupancy rates.

No doubt you want to enjoy the holiday home with family and friends but each time you are staying means a week’s loss of rent that you could be gaining. Not to mention, the times you would choose to stay is a time others would like to hire out your property.

3. General money matters

Unfortunately, when you choose to finally sell your holiday home, you will have to pay capital gains tax on it. This cannot even be avoided when just simply transferring someone else’s name onto it.

Attractive tax deductions such as travel expenses to inspect your property may look great but the cost of travel is not allowable as a tax deduction if your traveling has anything to do with the personal use of your property.

When buying a holiday home and renting it out, you must declare the income in your tax return. If you use your property for your own purposes for part of the year and then hire it out as an investment property for the rest of the year, you will need to convince the Tax Office that the property is a genuine investment.

4. Other hidden costs of holiday rentals:

- Property management costs are charged at higher rate for holiday properties which is often 15% of your rental income.

- You will also need to provide household items. Things like air-conditioning and barbeques as well as DVD players and Foxtel.

- You need to budget for the replacement costs for appliances such as fridges and washing machines which often break down.

- The annual maintenance cost for holiday properties is often about 4% or 5% of rental income. This is much higher than that of a regular rental property in the capital cities.

Multiple tenancies in peak holiday periods means you are likely to have much higher property maintenance costs in your holiday property. If your looking at managing your holiday home your self there are great websites out there like Air BnB or Hotels.com.

Download a FREE Home Buyers Guide, an easy to understand booklet designed to help you through the process of buying. Your copy of the property buyer’s guide can be

Download a FREE Home Buyers Guide, an easy to understand booklet designed to help you through the process of buying. Your copy of the property buyer’s guide can be